Top 10 Tips To Choosing The Best Ai Platform For Ai Stock Trading, From The Penny To copyright

The right AI platform is essential for success in stock trading. Here are 10 essential tips to help you make the right choice:

1. Define your trading goals

Tips: Choose your primary focus – penny stock, copyright, both – as well as whether you’re interested in long-term investing, short term trades, algorithm-based automated trading or even automation.

The reason: Different platforms are great at certain things; being clear on your goals will enable you to pick the one that best suits your needs.

2. Evaluate the predictive accuracy

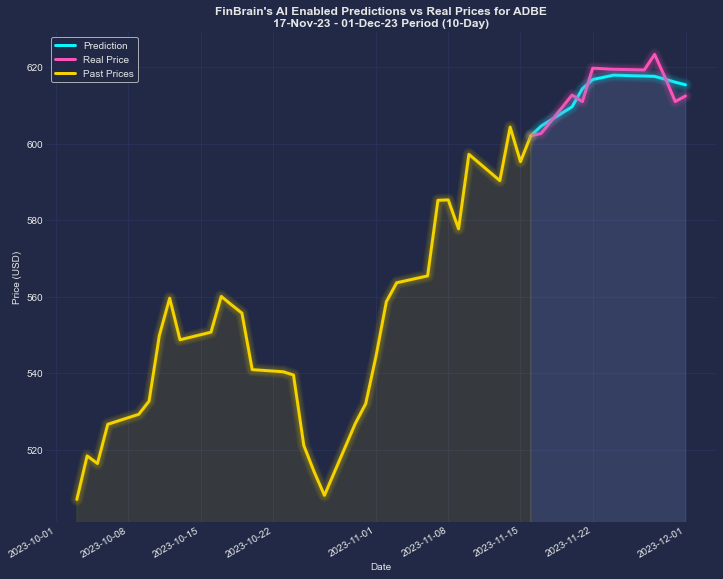

Verify the platform’s accuracy in forecasting.

How to find published backtests, user reviews, or the results of a demo trade to determine the credibility of the company.

3. Look for Real-Time Data Integration

Tip. Check that your platform is able to integrate real-time market feeds. Particularly for investments that move quickly like penny shares and copyright.

Why? Data that is not updated can cause missed opportunities or poor trade execution.

4. Evaluate Customizability

Tip : Pick platforms that let you customize parameters, indicators and strategies to suit the style of trading you prefer.

For instance, platforms such as QuantConnect and Alpaca provide a wide range of customizable options to tech-savvy users.

5. The focus is on automation features

Tips: Be on the lookout for AI platforms which have strong automated capabilities, including stop-loss features, take-profit features, and trailing stops.

What is the benefit: Automation is a time-saver and allows for exact trade execution, especially in markets that are volatile.

6. Use tools to evaluate sentiment analysis

Tips: Choose platforms with AI-driven sentiment analysis. This is especially important for copyright and penny stocks, which are often influenced by news, social media and news.

Why: Market perception can be a key driver behind the short-term price fluctuations.

7. Prioritize the Ease of Use

TIP: Ensure that the platform has a user-friendly interface and clear documentation.

Why: A steep and lengthy learning curve could hinder your ability to trade efficiently.

8. Examine for Compliance

Check that the platform is in compliance with local regulations on trading.

copyright: Check features that support KYC/AML.

If you are investing in penny stocks: Be sure to follow SEC guidelines or an equivalent.

9. Cost Structure Analysis

Tip: Understand the platform’s pricing–subscription fees, commissions, or hidden costs.

The reason is that a costly platform could reduce the profits of a company, particularly for penny stocks as well as copyright.

10. Test via Demo Accounts

Try demo accounts to try the platform and avoid risking your money.

The reason: Demos can let you know if your platform’s performance and capabilities meet your expectations.

Bonus: Make sure to check Community and Customer Support

Look for platforms which have solid support and active users groups.

The reason: The advice of peers and reliable support can help you troubleshoot problems and refine your plan of action.

If you take your time evaluating the platforms on these criteria You’ll be able to find the one that aligns most closely to your trading style regardless of whether you’re trading penny stocks, copyright or both. Read the recommended artificial intelligence stocks advice for blog info including stock analysis app, ai trading platform, ai penny stocks to buy, ai investing app, ai stock trading bot free, incite, stock analysis app, best ai stocks, ai stock trading bot free, ai stock price prediction and more.

Top 10 Tips To Pay Attention To Risk Metrics Ai Stock Pickers, Forecasts And Investments

It is crucial to pay attention to risks in order to make sure that your AI stockspotter, forecasts and investment strategies remain well-balanced and resilient to market fluctuations. Understanding the risk you face and managing it can aid in avoiding huge losses while also allowing you to make informed and based on data-driven decisions. Here are 10 best strategies for integrating AI investment strategies and stock-picking along with risk indicators:

1. Understanding key risk factors Sharpe ratios, Max drawdown, Volatility

Tip: Focus on key risk metrics such as the Sharpe ratio as well as the maximum drawdown and volatility to assess the risk-adjusted performance of your AI model.

Why:

Sharpe ratio measures the amount of return on investment compared to the level of risk. A higher Sharpe ratio indicates better risk-adjusted performance.

You can use the maximum drawdown to calculate the largest loss between peak and trough. This will allow you to comprehend the potential for huge losses.

The measure of volatility is market risk and the fluctuation of price. Higher volatility implies more risk, while low volatility signals stability.

2. Implement Risk-Adjusted Return Metrics

Tip: Use risk-adjusted return metrics such as the Sortino ratio (which is focused on risk associated with downside) and Calmar ratio (which compares returns to the highest drawdowns) to evaluate the true effectiveness of your AI stock picker.

Why: These metrics focus on how well your AI model performs in the context of the risk level it carries which allows you to evaluate whether returns justify the risk.

3. Monitor Portfolio Diversification to Reduce Concentration Risk

Tip: Use AI to help you optimize and manage your portfolio’s diversification.

The reason is that diversification reduces the risk of concentration, which occurs when a sector, stock and market are heavily dependent on a portfolio. AI can be utilized to determine correlations and then adjust allocations.

4. Monitor Beta for Market Sensitivity to track

Tips: The beta coefficient can be used to determine the degree of the sensitivity your portfolio or stocks have to market changes.

Why is that a portfolio with a Beta greater than 1 is volatile. A Beta less than 1 indicates a lower volatility. Understanding beta is essential to tailor risk according to investor risk tolerance and market movements.

5. Implement Stop Loss and Take Profit Limits based on the risk tolerance

Tips: Make use of AI-based risk models and AI-based predictions to determine your stop-loss levels and profit levels. This will help you reduce losses and increase profits.

The reason is that stop-losses are made to shield you from massive losses. Take-profit levels can, on the other hand can help you lock in profits. AI can be utilized to determine optimal levels, based on prices and fluctuations.

6. Monte Carlo simulations may be used to determine risk in situations

Tip: Use Monte Carlo simulations in order to simulate various possible portfolio outcomes, under different market conditions.

What is the reason: Monte Carlo simulations allow you to evaluate the future probabilities performance of your portfolio, which helps you prepare for different risk scenarios.

7. Use correlation to assess the systemic and nonsystematic risk

Tip: Use AI to help identify the market risk that is unsystematic and not systematically identified.

The reason is that systematic and unsystematic risks have different effects on the market. AI can be used to identify and reduce unsystematic or correlated risk by suggesting less risk assets that are less correlated.

8. Monitoring Value at Risk (VaR) to Quantify Potential loss

Tips – Use Value at Risk (VaR) models that are based on confidence levels, to determine the risk in a portfolio over an amount of time.

The reason: VaR is a way to have a clearer idea of what the worst case scenario could be in terms of losses. This allows you assess your risk exposure in normal conditions. AI will assist you in calculating VaR dynamically in order to account for changes in market conditions.

9. Set dynamic risk limit based on current market conditions

Tips: Make use of AI to adjust the risk limit based on the volatility of markets and economic conditions, as well as correlations between stocks.

The reason: Dynamic risks your portfolio’s exposure to risky situations when there is a high degree of volatility or uncertain. AI can use real-time analysis to make adjustments to help ensure that your risk tolerance is within acceptable limits.

10. Make use of machine learning to predict risk factors as well as tail events

Tips: Make use of machine learning algorithms that are based on sentiment analysis and data from the past to identify the most extreme risk or tail-risks (e.g. market crashes).

Why: AI models are able to identify patterns of risk that other models might overlook. This can help predict and prepare for unusual but rare market events. Investors can plan ahead to avoid catastrophic losses applying tail-risk analysis.

Bonus: Review risk metrics regularly with the changing market conditions

TIP: Continually refresh your risk and model indicators to reflect changes in geopolitical, economic or financial variables.

Why? Market conditions are always changing. Letting outdated models for risk assessment could result in inaccurate assessment. Regular updates will make sure that AI models are regularly updated to reflect market’s current trends and adjust to new risk factors.

Conclusion

By monitoring the risk indicators carefully and incorporating these metrics into your AI investment strategy including stock picker, prediction models and stock selection models, you can create an intelligent portfolio. AI provides powerful tools that allow you to monitor and evaluate risks. Investors are able make informed decisions based on data and balance potential returns with acceptable risks. These tips can help you build an effective risk management strategy that will improve your investment’s stability and profitability. Follow the most popular ai for stock market recommendations for blog examples including copyright ai, best ai stock trading bot free, free ai trading bot, ai copyright trading bot, best ai trading app, ai trade, investment ai, ai financial advisor, trading bots for stocks, ai investing and more.